24時間365日サポート — いつでもお客様をサポートいたします。

お問い合わせApplication Delivery Controller as a Service Market: In-Depth Analysis by Size

This research report expects the ADC as a Service market to grow further, given that organizations are focusing on their digital transformation strategies and are in search of flexible, simple, and efficient ways of enhancing their application delivery and user experience. The key stakeholders include significant cloud service providers, networking vendors, and specialized application delivery controllers’ vendors. All these entities compete to capture more market share through the provision of new and improved features and services. The growing use of cloud-native architectures and distributed application environments in businesses is expected to create a great market for ADC as a service. This will in turn lead to more innovation and competition within the market which is healthy for business.

IMR

Description

Application Delivery Controller as a Service Market Synopsis

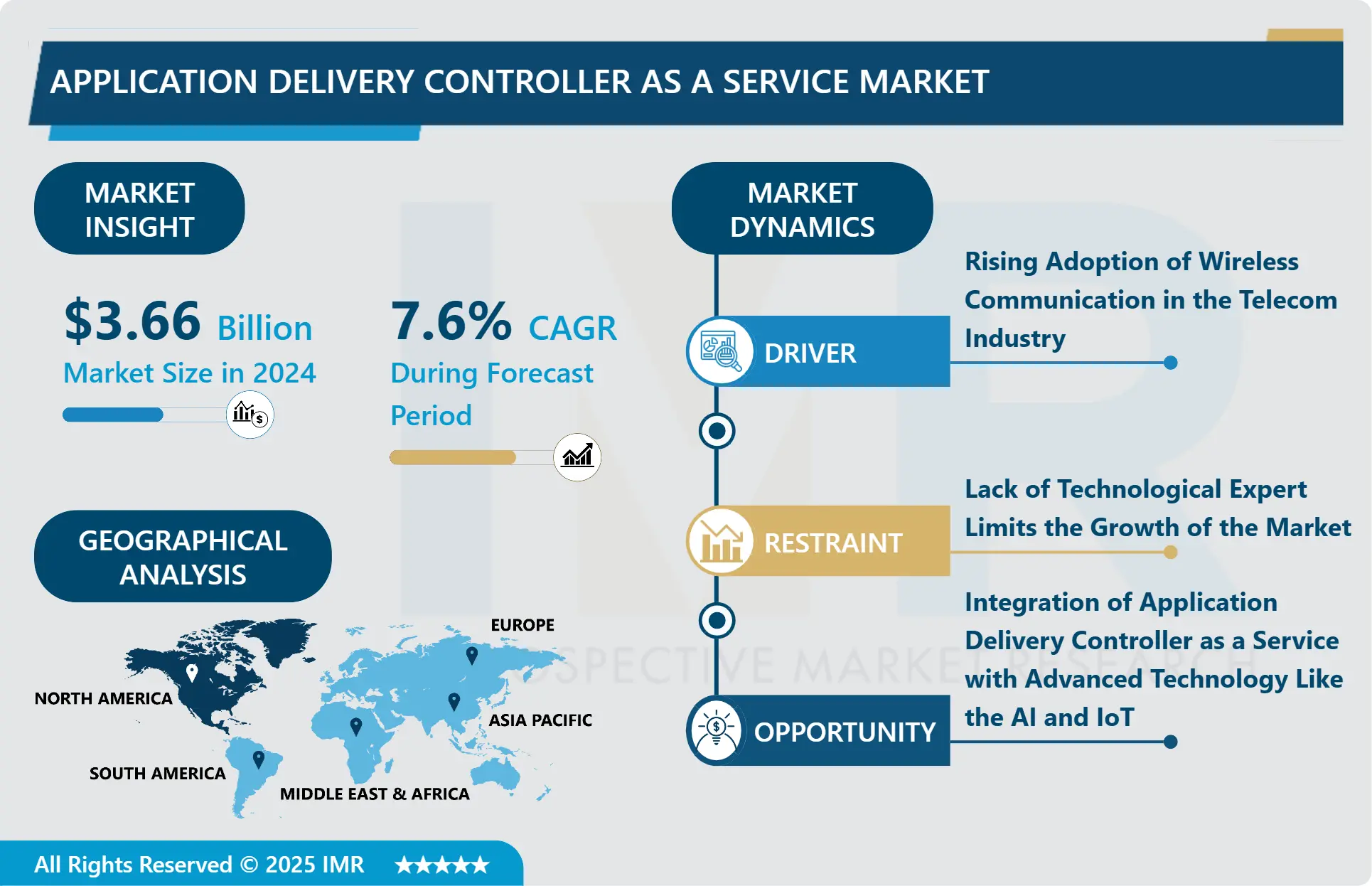

Application Delivery Controller as a Service Market Size Was Valued at USD 3.66 Billion in 2024, and is Projected to Reach USD 6.58 Billion by 2032, Growing at a CAGR of 7.6% From 2025-2032.

This research report expects the ADC as a Service market to grow further, given that organizations are focusing on their digital transformation strategies and are in search of flexible, simple, and efficient ways of enhancing their application delivery and user experience. The key stakeholders include significant cloud service providers, networking vendors, and specialized application delivery controllers’ vendors. All these entities compete to capture more market share through the provision of new and improved features and services. The growing use of cloud-native architectures and distributed application environments in businesses is expected to create a great market for ADC as a service. This will in turn lead to more innovation and competition within the market which is healthy for business.

Among the key factors that drive the demand for ADC as a Service are the increase in the use of cloud-based services and the transition to hybrid and multi-cloud environments. This is because as organizations try to enhance application delivery and guarantee user experience across many platforms and regions, the need for highly scalable and agile ADC solutions has become increasingly critical.

The featured services that come with ADC as a Service include load balancing, content caching, SSL offloading, and application security hhhhh play a crucial role in enhancing application performance and availability. This capability is especially advantageous to companies within industries that include e-commerce, finance, and healthcare, among others for which downtime or slow response time may possibly cost businesses in terms of revenue and reputation.

This is because when an organization chooses to adopt ADC as a Service, it does not have to make capital investments in hardware-based ADC appliances. Yet, they can utilize subscription-based models as a way of getting access to the ADC features and functionalities on the need basis. It not only helps in cutting down the overall cost at the first stage but also provides an opportunity for organizations to allocate resources accordingly to the need rather than having to buy excess resources which may not be used optimally.

Due to the increasing level of cyber threats, and the legal environment that governs organizations, it is important to maintain a sound security and compliance strategy. This is because the ADC as a Service providers incorporate security features including WAF, DDoS protection, and SSL encryption to allow organizations to protect their applications and meet set standards and compliance.

Application Delivery Controller as a Service Market Trend Analysis

Cloud-Native Architecture Adoption

The increasing need for streamlined application delivery solutions within cloud computing environments has led to the aggressive expansion of the ADC as a Service sector. Organizations necessitate ADC solutions that are scalable, agile, and dependable in order to optimize the performance, security, and availability of their applications as they migrate their workloads to the cloud.

The domain of application delivery has significantly transformed with the implementation of cloud-native architectures, distinguished by the use of containerization, microservices, and orchestration tools like Kubernetes. There is a growing trend of substituting or augmenting conventional hardware-based ADCs with software-based alternatives that better adhere to the tenets of cloud-native development and deployment.

Scalability and flexibility are key advantages of cloud-native application delivery controllers (ADCs). These controllers enable organizations to dynamically adjust their application delivery infrastructure in response to changes in demand. Elasticity is an essential attribute for managing heavy traffic volumes and maintaining consistent performance amidst surges in user activity.

By seamlessly integrating with DevOps tools and automation frameworks, cloud-native application delivery controllers enable organizations to automate application delivery service deployment, configuration, and management. By reducing manual labor and streamlining operations, this automation expedites the time required to bring new applications and updates to market.

Emphasis on Security and Performance

Security and performance are among the most important factors in using cloud-native architecture in the current and future world. Today, as more and more organizations are transitioning their applications and services to the cloud, they are learning the hard way that it is equally important to protect their data and systems and at the same time provide them faster and more reliable service to their customers.

There is one particular development that should be mentioned: more and more organizations are embracing cloud-native security. This also encompasses the embedding of security into the development life cycle through methods such as DevSecOps where security is not an add-on to the development process but rather a part of it. Industry solutions like container security platforms, runtime protection, and CSPM solutions are becoming popular in protecting CNAPPs and CNCF from emerging threats.

In the context of cloud-native architectures, there are several strategies that can be employed for performance optimization. This includes the use of containers and orchestration framework, for instance Kubernetes, for increasing scalability and optimization on resource, use of microservices and serverless architectures for increasing flexibility and decreasing latency. In addition, more and more organizations are leveraging advanced monitoring and observability tools to get a holistic view of how their applications are performing in real-time and where there might be opportunities for improvement.

In addition, cloud-native architectures are becoming more popular in modern applications and are leading to improvements in areas like edge computing and hybrid cloud. These strategies help the organizations in managing the workload more efficiently at the end user side with low latency while at the same time having complete control over the data through the concept of hybrid cloud computing.

Application Delivery Controller as a Service Market Segment Analysis:

Application Delivery Controller as a Service Market is Segmented on the basis of Type , Service and Enterprise Size

By Type, Hardware-Based segment is expected to dominate the market during the forecast period.

This has led to the need for cloud-native Application Delivery Controller (ADC) solutions that can consolidate management and deliver scalable load balancing across hybrid environments.

These are more economical than the conventional hardware-based ADCs as they allow organisations to only use what they need and, in the process, avoid the need to invest in physical equipment.

As the name implies, the ADCaaS solutions provide organizations with the required flexibility in terms of deployment and scaling of application delivery services in a bid to meet various business needs and traffic demands.

Such providers may offer features and functionalities like WAF, which can help organizations improve the security of their applications and conform to compliance norms without having to spend on other security solutions.

By Service, Training segment held the largest share in 2024

Training programs are provided by ADCaaS providers with the purpose of instructing customers on the optimal utilization of their ADC solutions, including their features, functionalities, and best practices. The instructional activities may encompass online courses, seminars, and documentation, all aimed at equipping participants with the requisite understanding to optimize the return on their ADCaaS investment.

ADCaaS deployments require robust support services in order to address technical issues, resolve inquiries, and guarantee their seamless operation. Support providers furnish customers with a range of communication channels, including online messaging, email ticketing systems, and phone support, to aid them in resolving issues and preserving system availability.

Integration & Implementation: To assist clients in integrating ADC solutions seamlessly with their existing infrastructure and applications, ADCaaS providers offer integration and implementation services. This process may encompass adjustments, setup, and evaluation in order to guarantee optimal functionality and compatibility across diverse environments.

Continuous maintenance services are essential for ensuring the security, up-to-dateness, and performance optimization of ADCaaS deployments. Proactive monitoring and routine updates, upgrades, and identification of potential issues prior to their impact on service delivery are implemented by providers. To further guarantee the enduring prosperity of ADCaaS deployments, maintenance services might encompass capacity planning, performance optimization, and lifecycle management

Application Delivery Controller as a Service Market Regional Insights:

North America dominated the largest market in 2024

North America has many tech companies and start-ups that are contributing to the advancement of cloud-native architecture and digital transformation strategies. This region boasts of a mature cloud services market, data center, and networking infrastructure to support the delivery of ADCaaS.

North American enterprises have been using ADC as a service (ADCaaS) solutions because they can easily maximize the value of shifting their application delivery and other related functions to the cloud. The developed IT infrastructure and the strong interest of the region in adopting new technologies have led to the growth of the ADCaaS market.

Current leading vendors and new entrants in the ADCaaS market have made a significant focus on the North American market due to the high demand for cloud services and efficient application delivery solutions. These investments have included strategic alliances, and the purchase of other companies, as well as increased spending on sales and marketing activities in order to take market share.

In North America, there are clear set of rules and regulations that govern data privacy and security, this has contributed to the increased uptake of ADCaaS solutions that have strong compliance features. The primary drivers for the adoption of ADCaaS are enterprises from industries like finance, healthcare, and government as it can assist in the achievement of compliance requirements besides enhancing application delivery and security.

Active Key Players in the Application Delivery Controller as a Service Market

F5 Networks Inc.

Array Networks Inc.

Citrix Systems Inc.

A10 Networks Inc.

Barracuda Networks Inc.

Fortinet Inc.

Cloudflare Inc.

Radware Ltd

Kemp Technologies Inc

NFWare Inc.

Brocade Communications Systems LLC

Evanssion

Cisco Systems, Inc.

Microsoft Corporation

Amazon Web Services (AWS)

IBM Corporation

Oracle Corporation

Pulse Secure, LLC

Sangfor Technologies Inc.

AVI Networks (acquired by VMware, Inc.)

Array Networks, Inc.

EdgeNexus Ltd

Riverbed Technology Inc., and Others Active Players.

Key Industry Developments in the Application Delivery Controller as a Service Market:

In April 2024, Panasonic Entertainment & Communication Co., Ltd. announced that it had successfully delivered the IT/IP platform KAIROS, designed to support live production for broadcasters, to customers worldwide. This achievement was made possible through collaboration with KAIROS Alliance Partners. KAIROS offers advanced solutions for live broadcast controllers, enhancing production capabilities across the globe. The initiative underscores Panasonic’s commitment to providing cutting-edge technology for the broadcast industry, ensuring high-quality and efficient live production workflows. The global delivery of KAIROS marks a significant milestone in meeting the demands of modern broadcasting.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Application Delivery Controller as a Service Market by Type (2018-2032)

4.1 Application Delivery Controller as a Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware-Based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software/Virtual Based

Chapter 5: Application Delivery Controller as a Service Market by Service (2018-2032)

5.1 Application Delivery Controller as a Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Training

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Support

5.5 Integration & Implementation

5.6 Maintenance

Chapter 6: Application Delivery Controller as a Service Market by Enterprise Size (2018-2032)

6.1 Application Delivery Controller as a Service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small & Medium Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Application Delivery Controller as a Service Market by End User (2018-2032)

7.1 Application Delivery Controller as a Service Market Snapshot and Growth Engine

7.2 Market Overview

7.3 IT and telecom sector

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 BFSI

7.5 Retail

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Application Delivery Controller as a Service Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ROCKWELL AUTOMATION

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MICROMAIN

8.4 SORTLY

8.5 EZO

8.6 FINALE INVENTORY

8.7 INFOR

8.8 MIDMARK COMOJIX

8.9 PCCW SOLUTIONS

8.10 TRIMBLE INCAND OTHER KEY PLAYERS

8.11

Chapter 9: Global Application Delivery Controller as a Service Market By Region

9.1 Overview

9.2. North America Application Delivery Controller as a Service Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Hardware-Based

9.2.4.2 Software/Virtual Based

9.2.5 Historic and Forecasted Market Size by Service

9.2.5.1 Training

9.2.5.2 Support

9.2.5.3 Integration & Implementation

9.2.5.4 Maintenance

9.2.6 Historic and Forecasted Market Size by Enterprise Size

9.2.6.1 Small & Medium Enterprises

9.2.6.2 Large Enterprises

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 IT and telecom sector

9.2.7.2 BFSI

9.2.7.3 Retail

9.2.7.4 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Application Delivery Controller as a Service Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Hardware-Based

9.3.4.2 Software/Virtual Based

9.3.5 Historic and Forecasted Market Size by Service

9.3.5.1 Training

9.3.5.2 Support

9.3.5.3 Integration & Implementation

9.3.5.4 Maintenance

9.3.6 Historic and Forecasted Market Size by Enterprise Size

9.3.6.1 Small & Medium Enterprises

9.3.6.2 Large Enterprises

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 IT and telecom sector

9.3.7.2 BFSI

9.3.7.3 Retail

9.3.7.4 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Application Delivery Controller as a Service Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Hardware-Based

9.4.4.2 Software/Virtual Based

9.4.5 Historic and Forecasted Market Size by Service

9.4.5.1 Training

9.4.5.2 Support

9.4.5.3 Integration & Implementation

9.4.5.4 Maintenance

9.4.6 Historic and Forecasted Market Size by Enterprise Size

9.4.6.1 Small & Medium Enterprises

9.4.6.2 Large Enterprises

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 IT and telecom sector

9.4.7.2 BFSI

9.4.7.3 Retail

9.4.7.4 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Application Delivery Controller as a Service Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Hardware-Based

9.5.4.2 Software/Virtual Based

9.5.5 Historic and Forecasted Market Size by Service

9.5.5.1 Training

9.5.5.2 Support

9.5.5.3 Integration & Implementation

9.5.5.4 Maintenance

9.5.6 Historic and Forecasted Market Size by Enterprise Size

9.5.6.1 Small & Medium Enterprises

9.5.6.2 Large Enterprises

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 IT and telecom sector

9.5.7.2 BFSI

9.5.7.3 Retail

9.5.7.4 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Application Delivery Controller as a Service Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Hardware-Based

9.6.4.2 Software/Virtual Based

9.6.5 Historic and Forecasted Market Size by Service

9.6.5.1 Training

9.6.5.2 Support

9.6.5.3 Integration & Implementation

9.6.5.4 Maintenance

9.6.6 Historic and Forecasted Market Size by Enterprise Size

9.6.6.1 Small & Medium Enterprises

9.6.6.2 Large Enterprises

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 IT and telecom sector

9.6.7.2 BFSI

9.6.7.3 Retail

9.6.7.4 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Application Delivery Controller as a Service Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Hardware-Based

9.7.4.2 Software/Virtual Based

9.7.5 Historic and Forecasted Market Size by Service

9.7.5.1 Training

9.7.5.2 Support

9.7.5.3 Integration & Implementation

9.7.5.4 Maintenance

9.7.6 Historic and Forecasted Market Size by Enterprise Size

9.7.6.1 Small & Medium Enterprises

9.7.6.2 Large Enterprises

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 IT and telecom sector

9.7.7.2 BFSI

9.7.7.3 Retail

9.7.7.4 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Application Delivery Controller as a Service Market research report?

A1: The forecast period in the Application Delivery Controller as a Service Market research report is 2025-2032.

Q2: Who are the key players in the Application Delivery Controller as a Service Market?

A2: F5 Networks Inc.,Array Networks Inc.,Citrix Systems Inc.,A10 Networks Inc.,Barracuda Networks Inc.,Fortinet Inc.,Cloudflare Inc.,Radware Ltd,Kemp Technologies Inc,NFWare Inc.,Brocade Communications Systems LLC,Evanssion,Cisco Systems, Inc.,Microsoft Corporation,Amazon Web Services (AWS),IBM Corporation,Oracle Corporation,Pulse Secure, LLC,Sangfor Technologies Inc.,AVI Networks (acquired by VMware, Inc.),Array Networks, Inc.,EdgeNexus Ltd ,Riverbed Technology Inc., and Others Active Players.

Q3: What are the segments of the Application Delivery Controller as a Service Market?

A3: The By Type (Hardware-Based, Software/Virtual Based), Service (Training, Support, Integration & Implementation, Maintenance), Enterprise Size (Small & Medium Enterprises, Large Enterprises), and By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Application Delivery Controller as a Service Market?

A4: Application Delivery Controller as a Service (ADCaaS) is a cloud-based solution that provides organizations with advanced application delivery capabilities without the need to deploy and manage physical appliances. ADCaaS offers features such as load balancing, SSL offloading, application acceleration, and security functionalities, all delivered as a service from the cloud. This model enables organizations to optimize the performance, availability, and security of their applications while reducing the complexity and cost associated with traditional ADC deployments. With ADCaaS, businesses can dynamically scale their application delivery resources based on demand, leverage centralized management and monitoring capabilities, and ensure high availability and reliability for their mission-critical applications across diverse deployment environments, including on-premises data centers, public clouds, and hybrid infrastructures.

Q5: How big is the Application Delivery Controller as a Service Market?

A5: Application Delivery Controller as a Service Market Size Was Valued at USD 3.66 Billion in 2024, and is Projected to Reach USD 6.58 Billion by 2032, Growing at a CAGR of 7.6% From 2025-2032.

How to buy a report from Megatrends.jp

On the product page, select the license you want: Single User License or Enterprise License.

Select the report language:

- English Report

- English Report + Japanese Translation

Click the Buy Now button.

You’ll be redirected to the checkout page. Enter your company and payment details.

Click Place Order to complete your purchase.

Confirmation: You’ll receive an order confirmation email. Our team will then follow up with your report delivery.

If you have questions, fill out the contact form below or email us at sales1@megatrends.jp.

Thank you for choosing Megatrends.jp!